This page will cover our Conveyancing process for first home buyers, as well as information that will prepare readers if they are considering purchasing their first property.

Our advice to first home buyers is to be extremely organised. Contact a Conveyancer or Solicitor early in the process to ensure you are well informed about all the necessary legal proceedings.

Familiarise yourself with the property market and the Conveyancing process to set yourself up for success. it is also extremely important to obtain finance (pre-approval) as it will help you set realistic goals in terms of what properties are within your budget.

In NSW, first home buyers can be eligible for first home buyer initiatives, such as stamp duty exemptions, discounts, or building grants. This knowledge is valuable when budgeting for a property purchase.

THE PROCESS

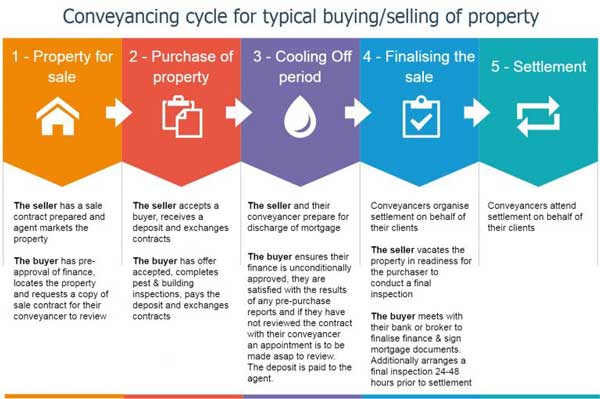

The diagram below represents the typical course of a property transaction. For first-home buyers, the process is the same as repeat buyers.

INITIATIVES FOR FIRST HOME BUYERS

To improve housing affordability, the NSW Office of State Revenue released a new first home buyers assistance scheme in July 2017. The scheme offers financial assistance to eligible first home buyers, typically in the form of stamp duty exemptions, discounts, and building grants for new homes.

For example, eligible new home buyers purchasing a new or existing property under $650,000, can be exempt from payment of stamp duty. For homes between $650,000 and $800,000 stamp duty discounts apply. There are also building grants of up to $10,000 for newly built homes.

There are many variations of this scheme, it is important to be aware of the benefits that may apply to you. Visit the NSW Office of State Revenue to learn more or contact your Conveyancer.

To apply for one of these schemes, a person must complete a First Home Buyers Assistance scheme form or a First Home Owner Grant (New Homes) form and satisfy eligibility criteria. Our team can help you submit these forms after you have exchanged contracts.

FREQUENTLY ASKED QUESTIONS

Contact Revenue NSW or visit their first homeowner grant website. On this website, you will be able to view the eligibility criteria.

Alternatively, you can contact us and we can help you work out your eligibility.

Contact Revenue NSW or visit their first home buyers assistance scheme. On this website, you will be able to view the eligibility criteria as well as calculators to determine your concession amount.

Alternatively, you can contact us and we can help you work out your eligibility.

The first homeowner grant and first home buyers assistance scheme are the major concessions for NSW’s first home buyers. It is important to note there are many variations of these schemes.

For example, even if you are purchasing 50% of the property, and another party is purchasing the remainder, you may still be able to receive a concession.

The best course of action is to discuss your situation with our team or Revenue NSW and they will help you identify if a concession applies to you.

Yes, it does, however, the changes are primarily the paperwork involved in obtaining finance, the remainder of the Conveyancing cycle is otherwise unchanged.

For example, the loan structure will be different and additional documentation will be required, as guarantors are usually guaranteeing against another property.

Therefore, there is additional documentation that needs to be prepared and signed by the guarantors.

HOW WE CAN HELP

If you are considering buying your first property Hunter Legal & Conveyancing can guide you in this process.

We provide upfront contract reviews and can help you understand your contract, prospective mortgage, legal fees, stamp duty, and concession eligibility.

Our clients are provided with regular updates, as well as notifications in the form of SMS, email, and phone calls. You can call us with any questions you may have, and expect a quick reply.

Purchasing a property is typically an unfamiliar process for first home buyers. We help our clients by educating them on the following;

- Avoiding being gazumped

- Preparing to buy at an auction

- Preparing to buy at a normal (known as private treaty) sale

- Organising pest and building reports if requested

- Explaining all details of the contract of sale

- Compiling all relevant documentation

- Explaining time frames and requirements

- The settlement process and collection of keys

HELPFUL LINKS

First Home Buyers Assistance Scheme – Revenue NSW

https://www.revenue.nsw.gov.au/grants/fhba

First Home Owner Grant (New Homes) Scheme – Revenue NSW

https://www.revenue.nsw.gov.au/grants/fhog

First Home Buyers Assistance Calculator – Revenue NSW

https://www.apps08.osr.nsw.gov.au/erevenue/calculators/fhba.php

Beginners Guide to Conveyancing – Hunter Legal & Conveyancing

https://www.hunterlegal.com.au/articles/beginners-guide-conveyancing/

First Home Buyers Choice and Shared Equity Home Buyer Helper Toolkits and fact sheets – Revenue NSW

First Home Buyer Choice Facts Sheet

First Home Buyer Choice Toolkit

Shared Equity Home Buyer Helper Facts Sheet

Shared Equity Home Buyer Helper Toolkit