The Conveyancing team at Hunter Legal & Conveyancing understands the financial details surrounding a property have a significant impact on your life, both now and long term.

Refinancing property requires careful planning, attention to detail, and consistent communication with many parties.

People refinance properties for many reasons, commonly to reduce debt through lower interest rates, debt consolidation, obtaining additional loans for investment purposes, improving loan structure (i.e. additional repayments or offset features), and changing their repayment amounts.

Of course, an early step of refinancing is to research the home loan products from multiple banks to see what rates and products are available (including related costs, like annual mortgage fees, honeymoon periods, and exit fees). People may wish to engage a mortgage broker or financial planner to assist with this.

In addition to refinancing a property, people often wish to address their insurance and superannuation accounts simultaneously.

COMMON COSTS ASSOCIATED WITH REFINANCING PROPERTY

There are several upfront costs when refinancing a property. However, long term, these costs should be outweighed by the savings in interest charges. The upfront costs usually include:

- Discharge of mortgage fee with NSW LRS (current price list here)

- Exiting a mortgage early fee (ask your bank)

- Application and processing fees with the new lender (ask new bank)

- Valuation fees (when a bank requires a valuation on the property)

- Lender’s mortgage insurance

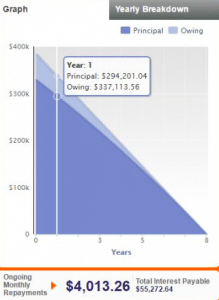

- Additionally, each bank can provide calculations that will show the repayments over the life of the loan (at the current interest rate). It’s also wise to calculate the repayments in the event of an interest rate rise to ensure you can meet the repayments in a worst-case scenario.

REFINANCING PROPERTY IN NSW – WHAT YOU NEED TO KNOW

As mentioned on our transferring property page. A bank will hold control of the Title over the property until the mortgage is repaid or they consent to the mortgage notation being removed.

Refinancing will require the existing mortgage to be discharged, enabling the Title to be transferred to a new owner or bank. The process is completed electrically with the NSW Land Registry Services.

Please browse our website to see if we’re a suitable firm for you. Alternatively, feel free to call our office on 1300 224 828 or use our contact page.

FREQUENTLY ASKED QUESTIONS

In terms of changing the Title with NSW LRS, there are no limits to how many times this can occur, you would simply pay the registration fee multiple times.

The limitation would lie within the individual bank’s policies and procedures on their home loan product. Discuss this with your bank.

Usually, you will be provided with same-day notice.

The majority of banks in Australia are part of the Australian Banking Association, which maintains a code of practice that members abide by. To ensure your bank is part of the Australian Banking Association, you can see if they are listed as a member here: https://www.ausbanking.org.au/about-us/aba-members/

According to the code (Chapter 38, Part 153) – “If we change an interest rate, we will tell you no later than the date of the change”.

To be as observant as possible towards interest rates, follow the Reserve Bank of Australia and contact your bank when necessary.

HOW WE CAN HELP

- Providing preliminary advice to align the refinance to align with your long term goals

- Collaborating with banks to ensure all the mortgage documentation is correctly prepared and submitted

- Advising on loan structure

- Working with your financial planner if required

- Liaising with your banks to assure settlement on the proposed date

- Submitting all necessary documents to the NSW Land Registry Services and paying all transfer costs on your behalf

- At the end of the refinance process, we’ll compile all the relevant documentation for you

HELPFUL LINKS

Australian Banking Association

https://www.ausbanking.org.au/

Fees 2018/19 – NSW LRS

https://www.nswlrs.com.au/__data/assets/pdf_file/0003/222924/2018_2019_NSW_LRS_Fees.pdf

Reserve Bank of Australia

https://www.rba.gov.au/