This page will summarise the Conveyancing process for selling property and should be particularly helpful for people preparing to sell.

Firstly, before a property can even be advertised a Contract of Sale needs to be prepared. A licensed Conveyancer or Solicitor can help prepare this and compile the necessary prescribed documents such as the Title Search, dealings, Drainage Diagrams, and Zoning Certificates that are obtained from the local council. As such, if you are considering selling a property, it is beneficial to contact a Conveyancer or Solicitor as early as possible.

In addition to preparing a Contract of Sale in advance, you may wish to consider the following:

- Whether you want to sell at auction or private treaty.

- Whether you want to engage an agent or sell the home yourself.

- Identifying a purchase price. This can be done through your own research, or via a valuation.

- Identifying costs associated with selling the property. Such as capital gains tax, agent fees, removalist fees, and bank fees.

While selling a property can be a stressful task, becoming familiar with the selling process and hiring a professional Conveyancer will set you up for a favourable outcome.

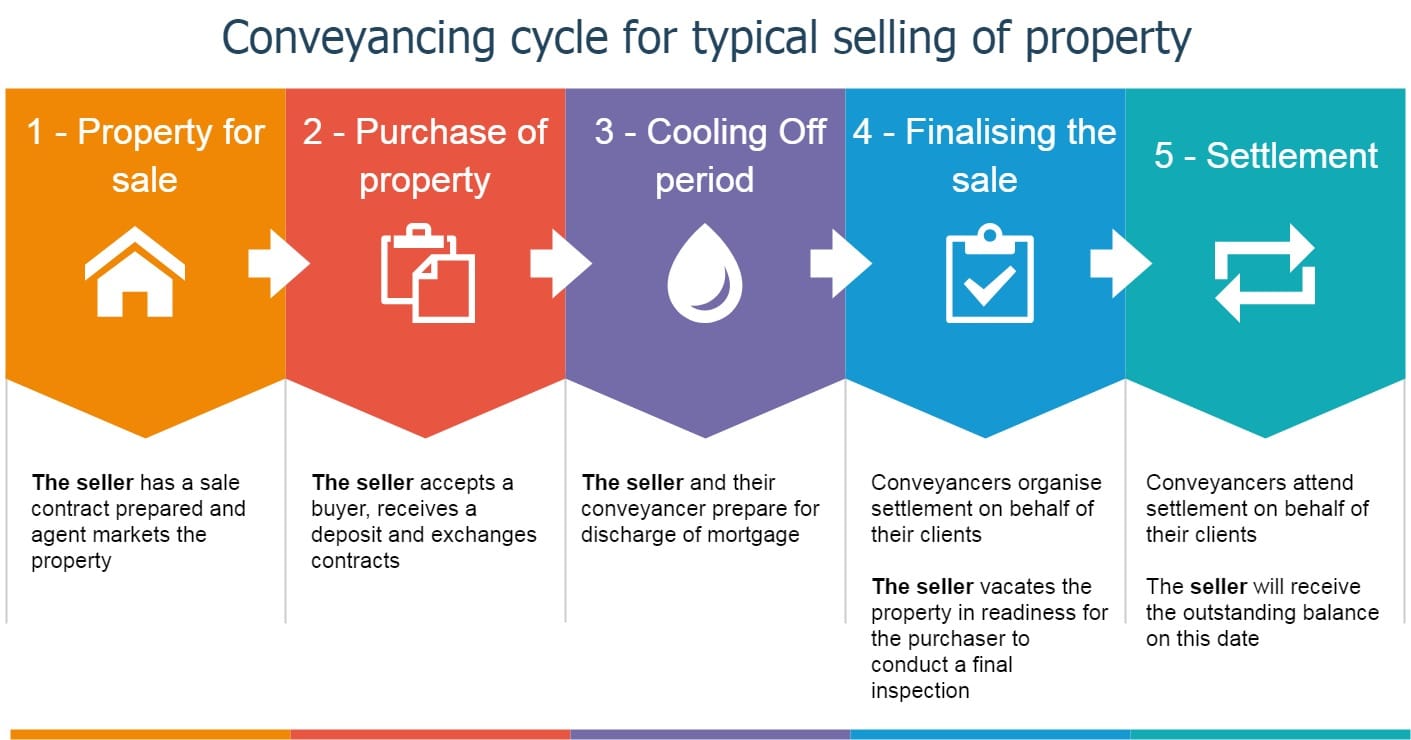

THE PROCESS OF SELLING PROPERTY

The below diagram represents the course a person will go through when selling a property.

SELLING PROPERTY IN NSW – WHAT YOU NEED TO KNOW

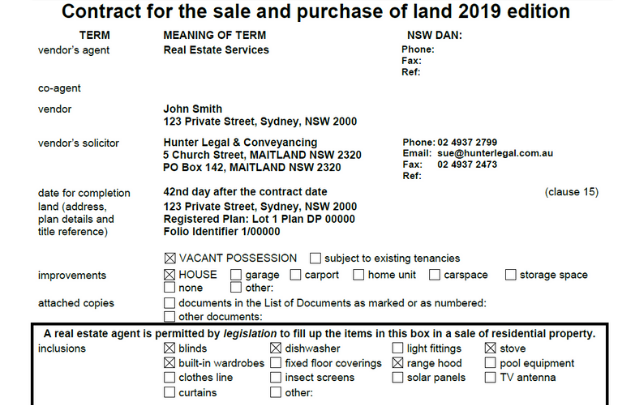

The Contract of Sale – must include the following:

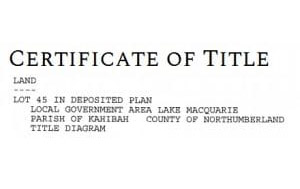

Title Search, which is the official document proving a party is the owner of a property.

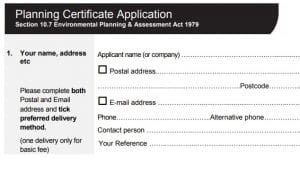

A 10.7 zoning certificate – this is issued by the local council and contains information relating to how a property may be used, as well as information relating to the council development of that property (i.e. new apartments being built next door). It is imperative that you understand this document, so you are aware of the current and future implications that council zoning may have on the property.

A drainage diagram, that highlights the location of sewerage systems from the property to the nearest main outlet.

In addition to the above, if a property has any dealings over the title such as easements, rights of way, restrictions, or covenants, then copies of these must be attached to the Contract of Sale.

If you would like to learn more about purchasing a property with easements or rights of way have a read of our “Are you purchasing a property with easements or right of Way? Know your property easement rights” article.

Without these documents, your Contract for Sale is not complete or valid.

If you would like to read more about the Conveyancing Process for selling a property in NSW have a read of our “Conveyancing Process NSW Sale” article.

CAPITAL GAINS TAX

Capital gains or capital loss occurs when you purchase an asset (i.e. a house) and then sell it later for a different amount. The Australian Taxation Office may impose a Capital Gains Tax (CGT) when selling a property.

If you are selling a property that has been your principal place of residence and you satisfy eligibility criteria, then you will receive an exemption from this capital gains tax.

If you are selling a property that is not your principal place of residence, such as an investment or business property, then it is likely you will be required to pay capital gains tax.

There are different factors to consider when calculating capital gains tax, such as an individual’s taxable income. In this case, we recommend seeking the professional advice of your Accountant.

FREQUENTLY ASKED QUESTIONS

A property valuation is when a real estate agent visits a property, evaluates it, and produces a sales appraisal document. The outcome is to identify an expected sale price for the property.

The value is calculated by many factors, such as market demand, recent sales, land size, building quality, investment opportunity, and council planning for that region.

Yes. If the pest and building inspection produces findings of significance, the buying party can request that the Agent or their Solicitor or Conveyancer negotiate with the selling party prior to exchanging contracts or during the cooling-off period.

Should the buyer decide to not purchase the property, they can withdraw from the sale or rescind during the cooling-off period. If they rescind during the cooling-off period they will be required to forfeit 0.25% of the purchase price being the deposit paid on the exchange of contracts.

Yes, they can, although this can incur a substantial cost.

If the buyer elects not to proceed with the purchase during the cooling-off period, they can rescind the contract for any reason whatsoever however, they will forfeit 0.25% of the purchase price to the Vendor, being the deposit paid on exchange of contracts. If a buyer wishes to withdraw from the purchase after the cooling-off period has expired or, following an unconditional exchange of contract (no cooling-off period) they will forfeit the full 10% deposit. Additionally, the buyer may be sued for losses by the selling party.

No.

No.

HOW WE CAN HELP

For a property sale, we will perform the following:

- Prepare a Contract of Sale that is compliant with NSW Conveyancing Act and regulations

- Obtain all documentation for inclusion into the Contract including i.e. title search, restrictions, instruments, deposited plan, 10.7 Certificate, Sewer Diagram, and any other notation which may be registered on title

- Assign a dedicated staff member to your campaign.

- Provide any guidance that you may need

- Liaise between buyers, agents, financial parties, councils and other stakeholders

- Keep you informed throughout the entire process

- Compile all relevant documentation

READY TO WORK WITH HUNTER LEGAL & CONVEYANCING?

- We offer exceptional service and regular communication in the form of texts, calls, meetings and online customer portals

- Our staff possess over 40 years combined experience in the Conveyancing discipline

- Our customers are never “too small to matter”, from first home buyers to property developers, we have the same attention to detail on every service

- We are able to help anyone within NSW with their Conveyancing needs

- We are experienced in all types of Conveyancing, from residential homes, commercial businesses, retirement villages and larger developments

HELPFUL LINKS

Capital Gains Tax – Australian Taxation Office

https://www.ato.gov.au/General/Capital-gains-tax/

Land Tax Exemptions & Concessions – Revenue NSW

https://www.revenue.nsw.gov.au/taxes/land/exemptions